How and why does the US stock market crash affect Hispanics in California?

LOS ANGELES, California.- In addition to the increases in the prices of gasoline and food, now the drop in the prices of shares in the US stock market is added. The combination of inflation and a possible recession will affect Hispanics as well, including eloteros and their customers on California street corners.

“The poor are going to get poorer and the rich will have more opportunities to invest,” Carlos Guamán, financial advisor, told Univision34 Los Angeles. Explaining who would be the most affected if the economic recession was officially declared in the US in July.

Guamán clarified the economic terms of inflation and recession, to put into perspective the impact they have and will have among the working class in California.

"Inflation is an increase in all the products of the basic basket, gasoline, rents," said Guamán. The expert explained that at least the increase in prices has been 8%, according to the latest report from the Federal Reserve. This is already happening in the golden state, with the most expensive gasoline price in the entire US and the increase in food prices, services and rents.

Regarding the recession, the economist said that it is an "economic contraction", this means that the economy does not grow, new jobs are not generated, but, on the contrary, those that exist are eliminated, that is to say , unemployment rises. As if that were not enough, to this scenario we must add the third increase in interest rates announced by the US Central Bank at the beginning of the year.

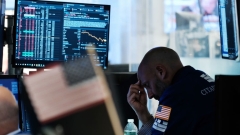

However, the recession is not an instantaneous event, it is the result of an analysis by economists in the country that justify why the country's economy has not grown for two consecutive semesters. The next evaluation will take place in the second week of July and therefore there are expectations and nervousness among investors.

Why are working class California affected by stock market indicators?

According to Guamán, the stock market is an early indicator of what is expected of a country's economy and could anticipate future situations, according to investor projections.

And it is that Wall Street continues to close lower, at a time when shareholders are increasingly concerned about inflation, the highest in four decades. The drop by almost 20% in the last month has caused nervousness in the markets.

For this reason, explains Guamán, that the more people buy or invest in securities, there is a feeling of a strengthened economy. If, on the other hand, there is a massive sale, then downward speculation generates a shock wave that affects even the elotero on the corner and his customers.

Why? Because corn prices are higher than a year ago and most likely, the people who used to buy corn now don't have enough money to eat on the street. That means that consumption is reduced, impacting from the shopkeeper to the largest companies that generate less income.

Comments to this: